Cris brings 20 years of banking and finance experience, most recently advising institutional size clients at Citi Private Bank in Switzerland. He was inspired to create GWAP with high wealth management standards and an intuitive interface that makes it easy to use by non-professionals.

Ready for systematic, professional investing?

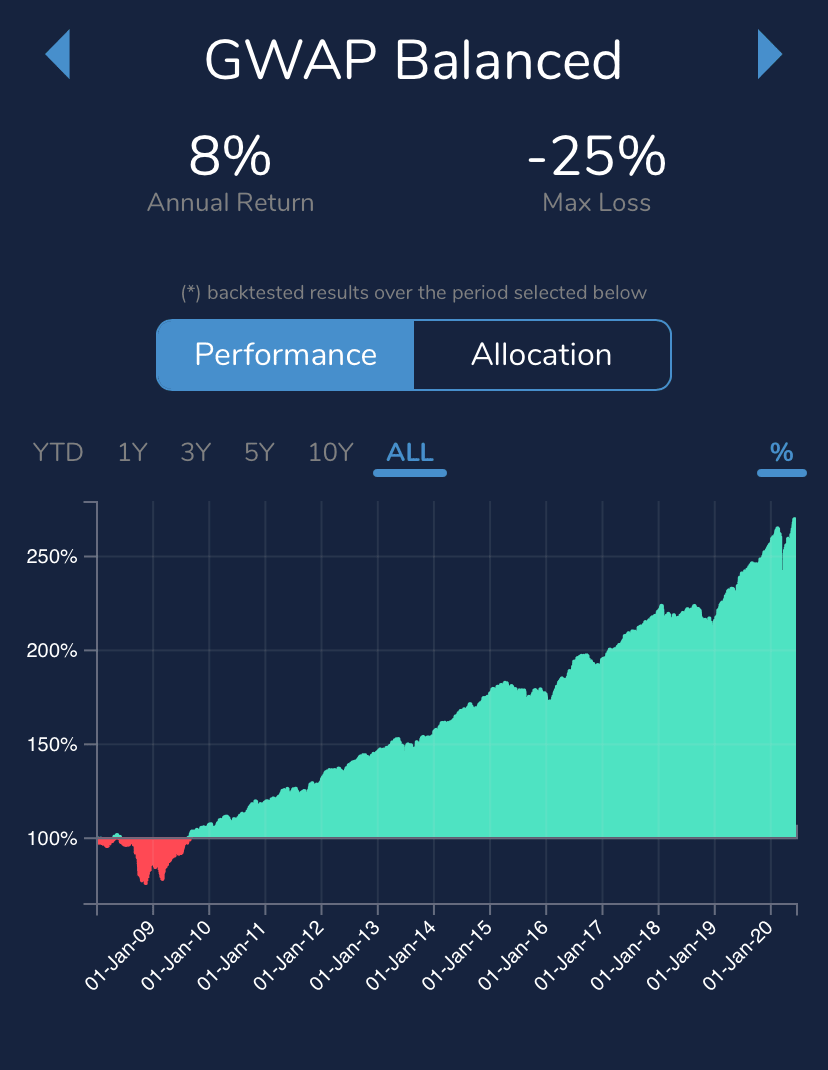

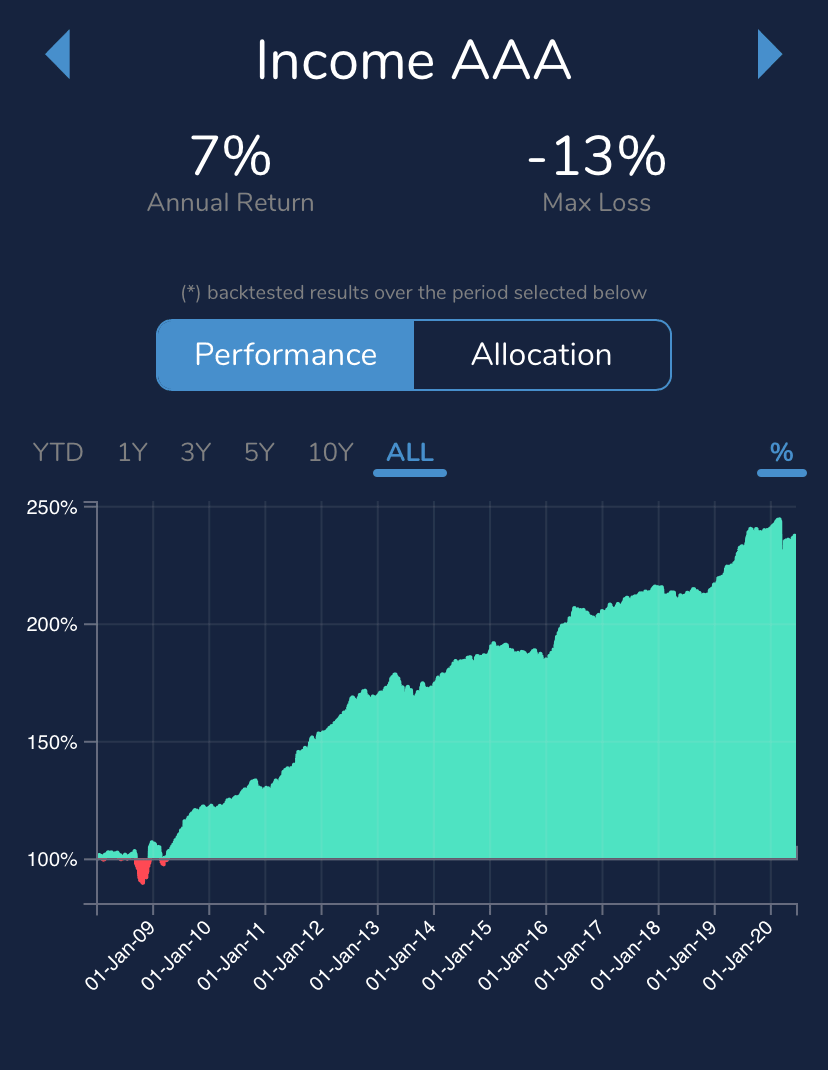

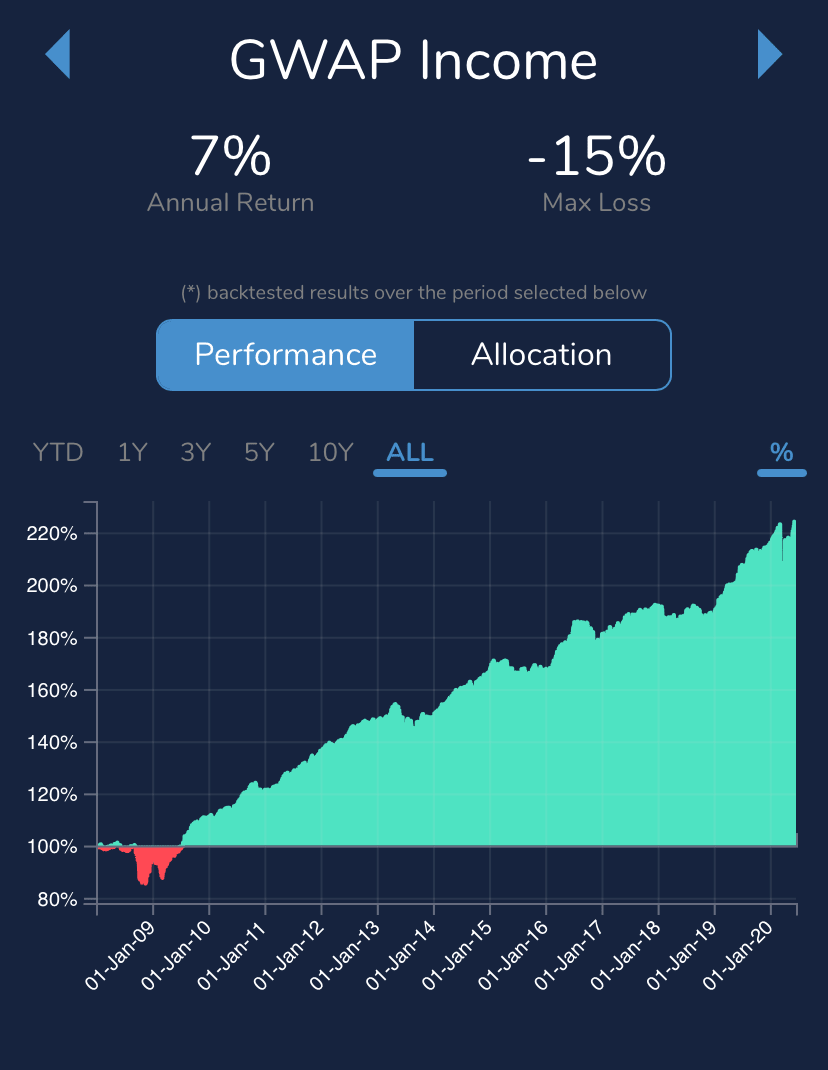

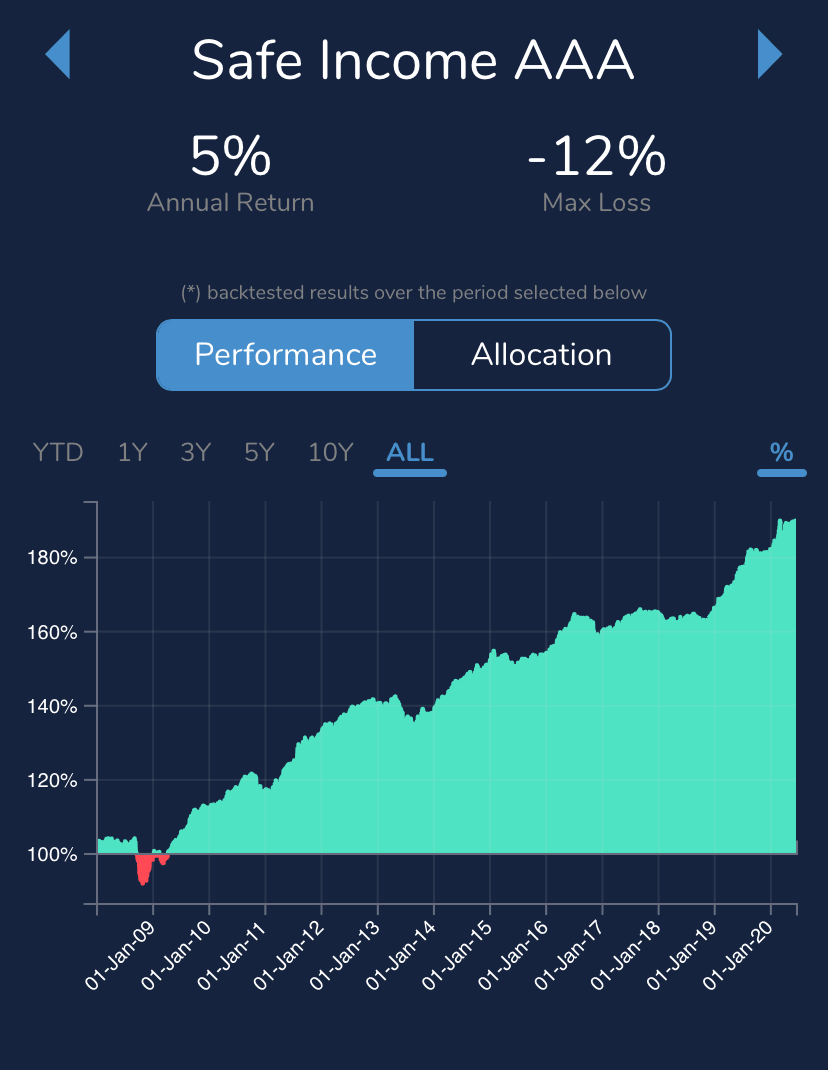

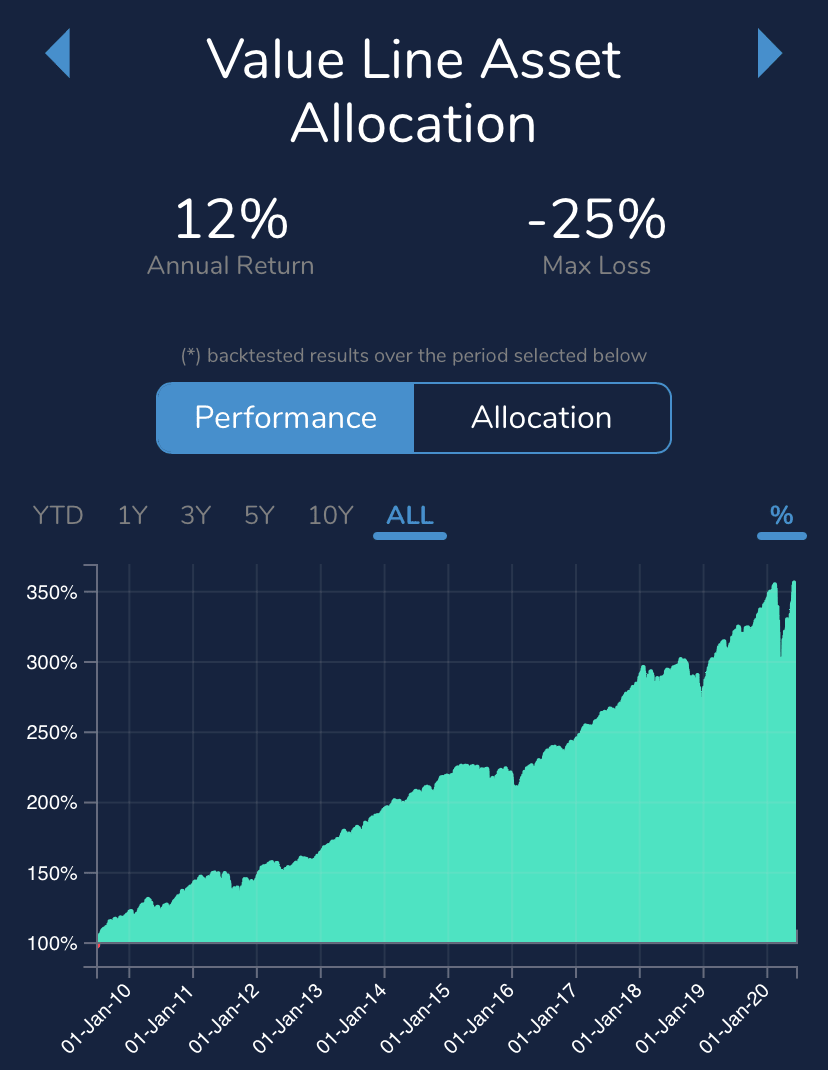

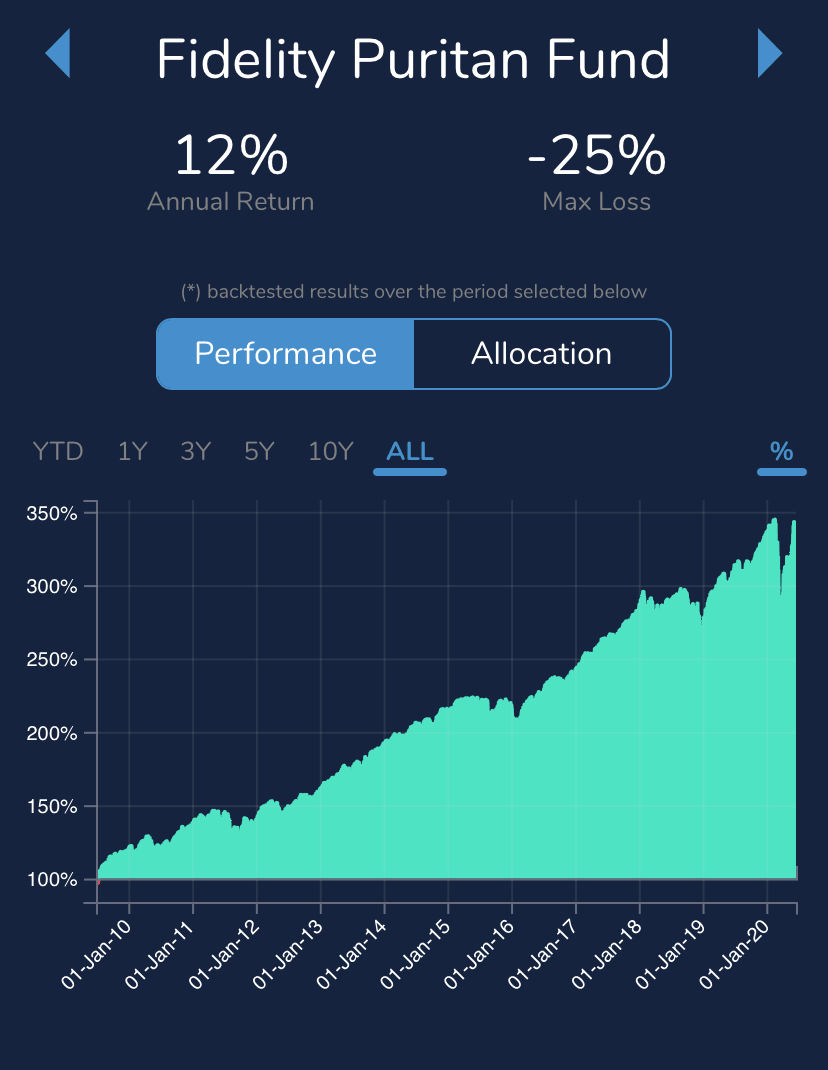

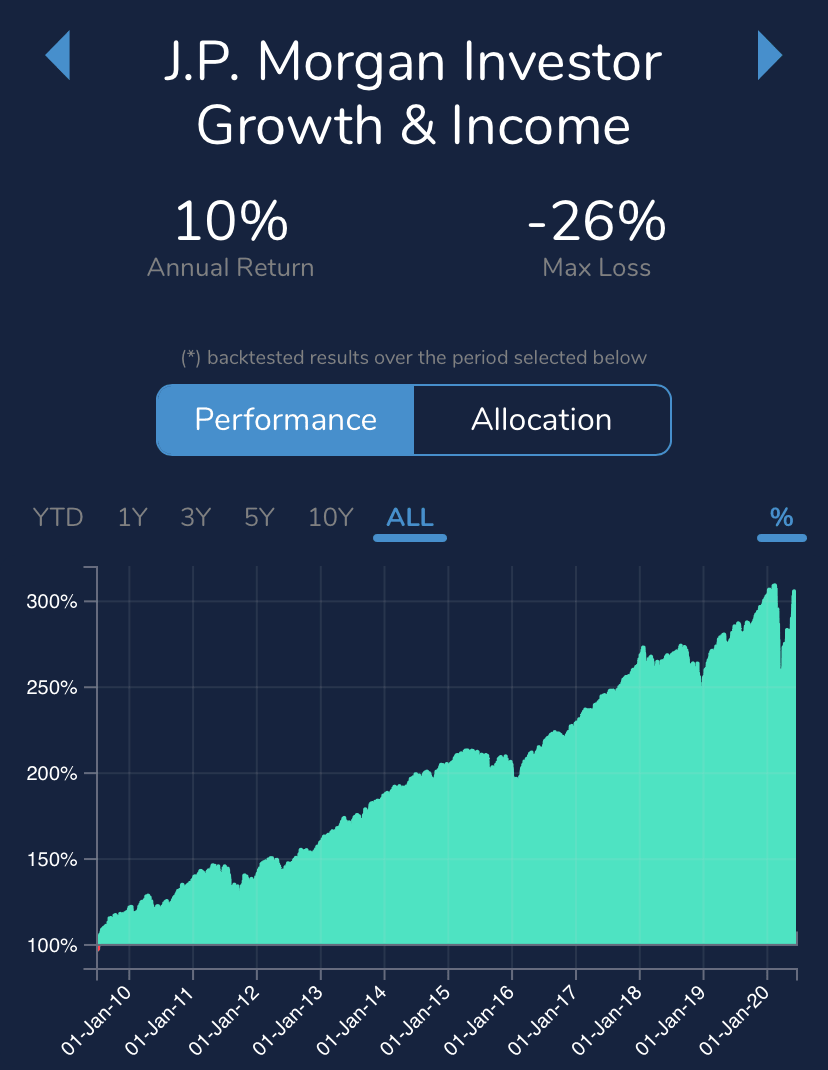

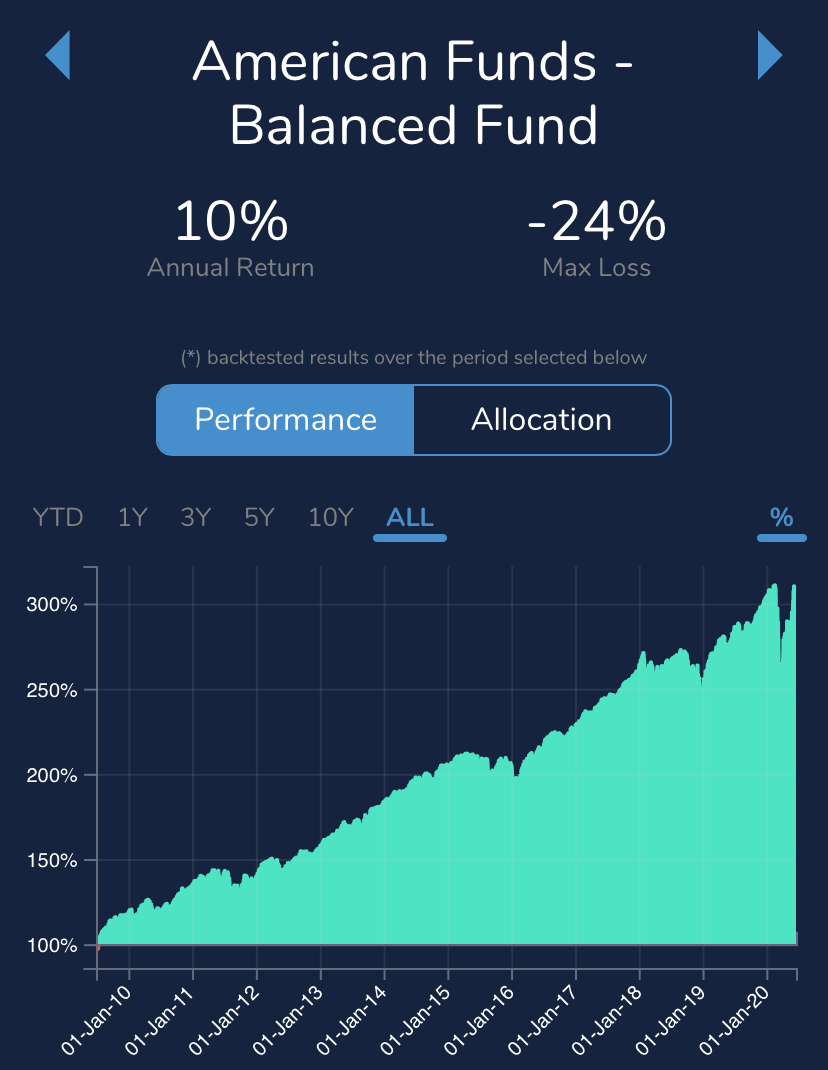

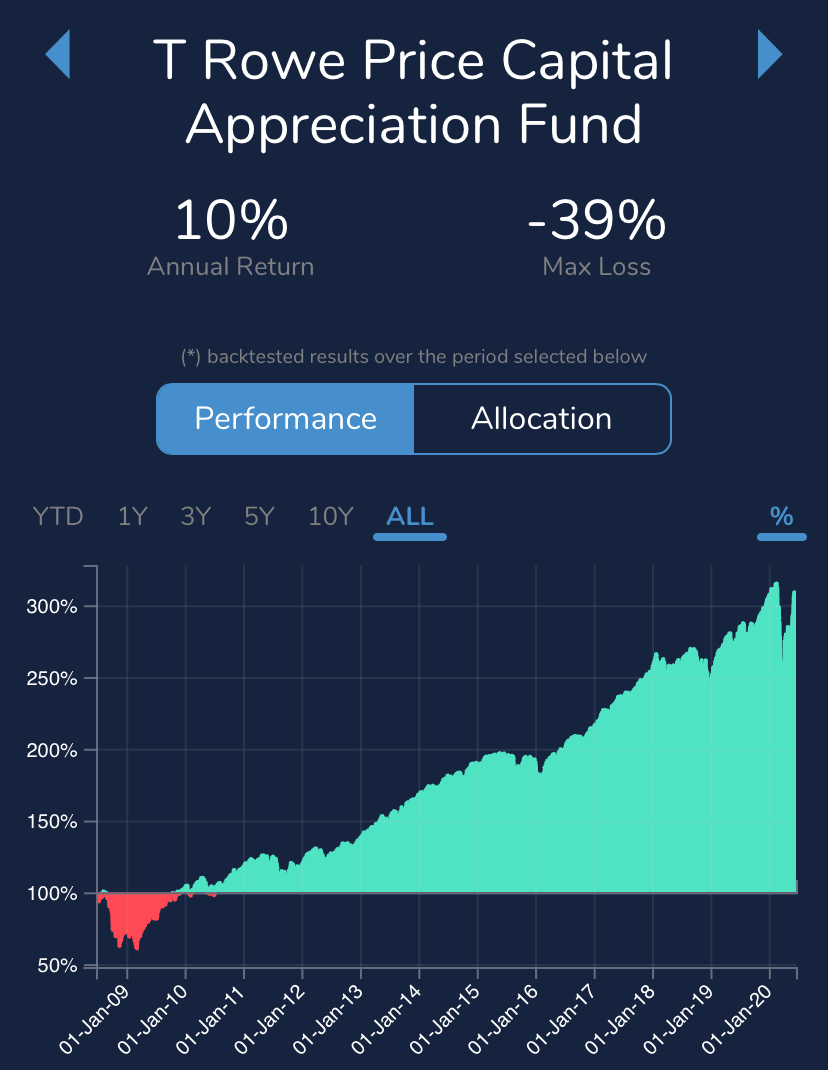

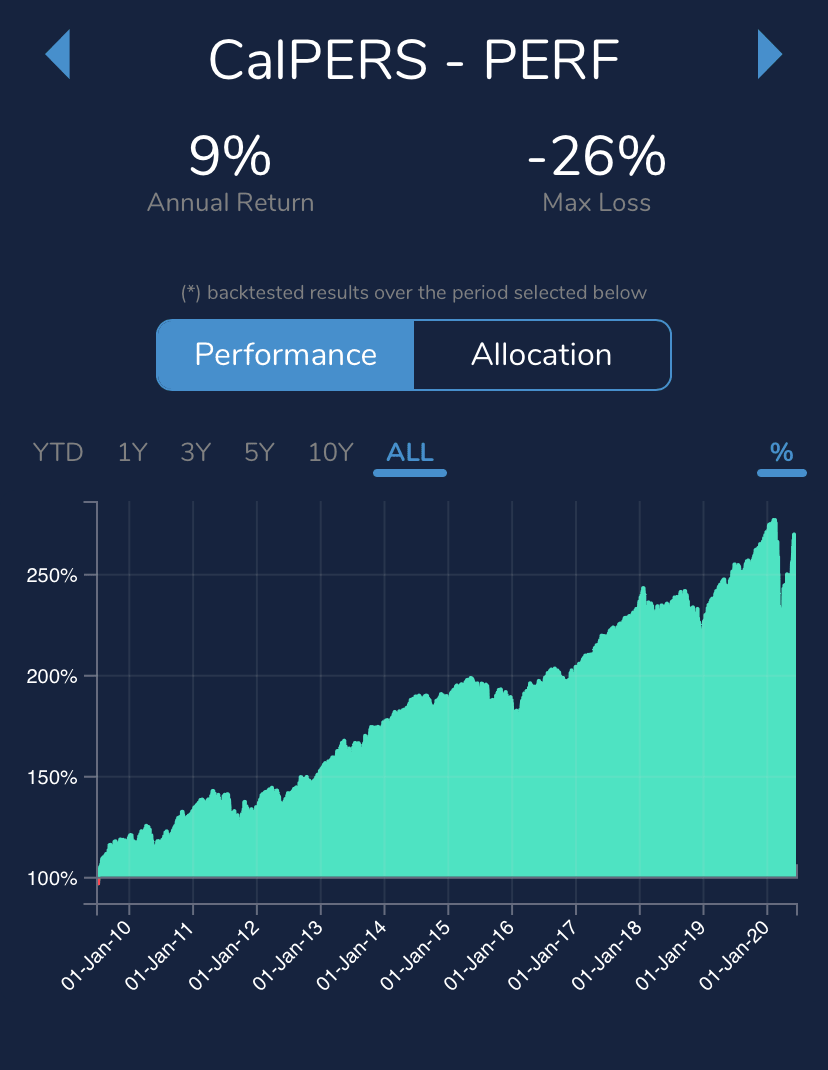

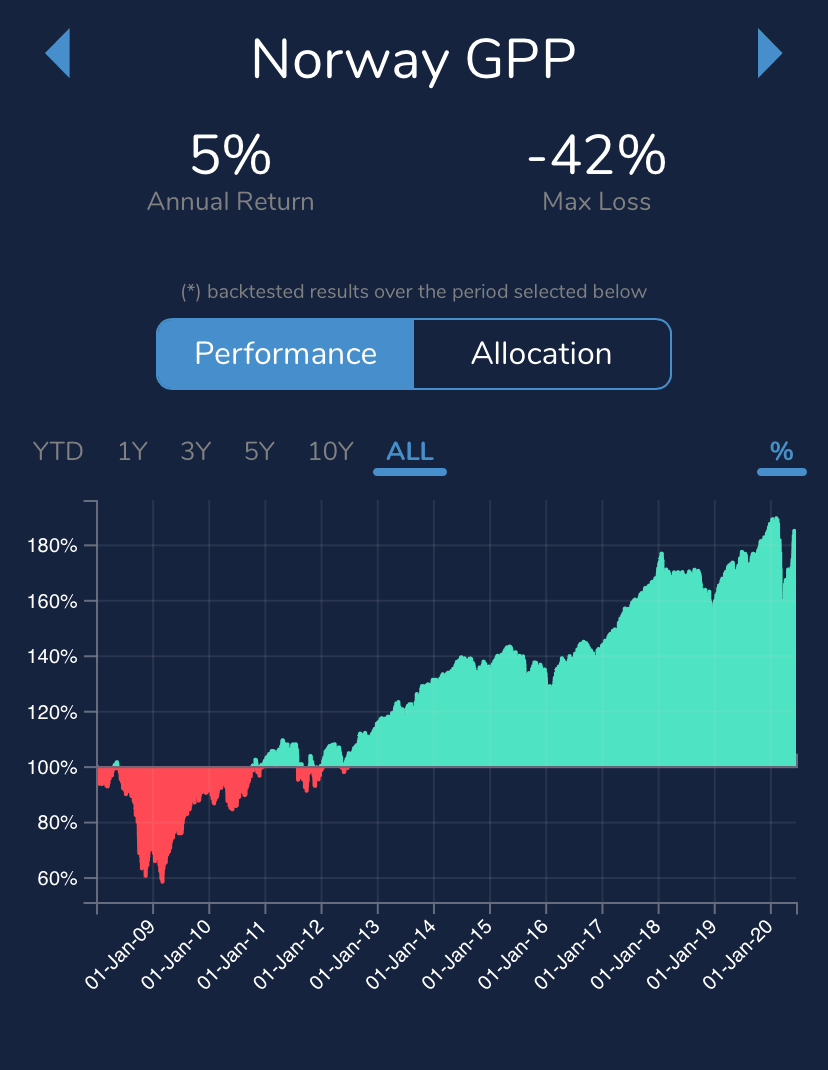

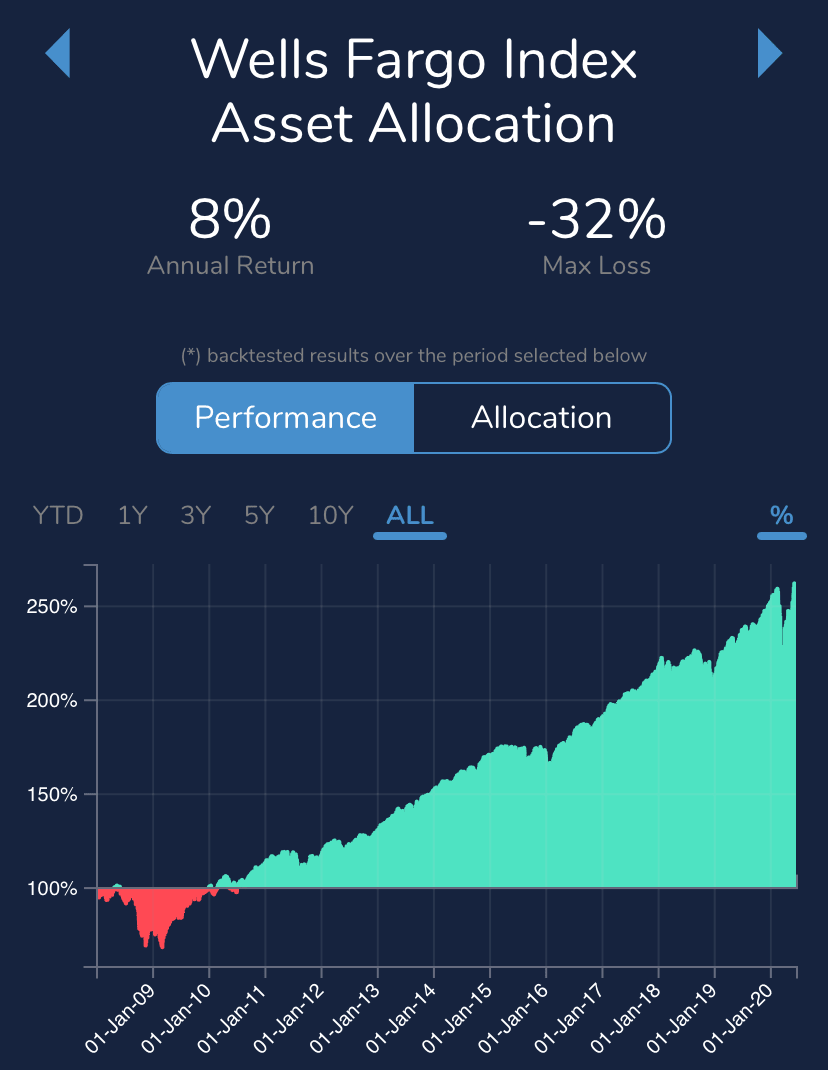

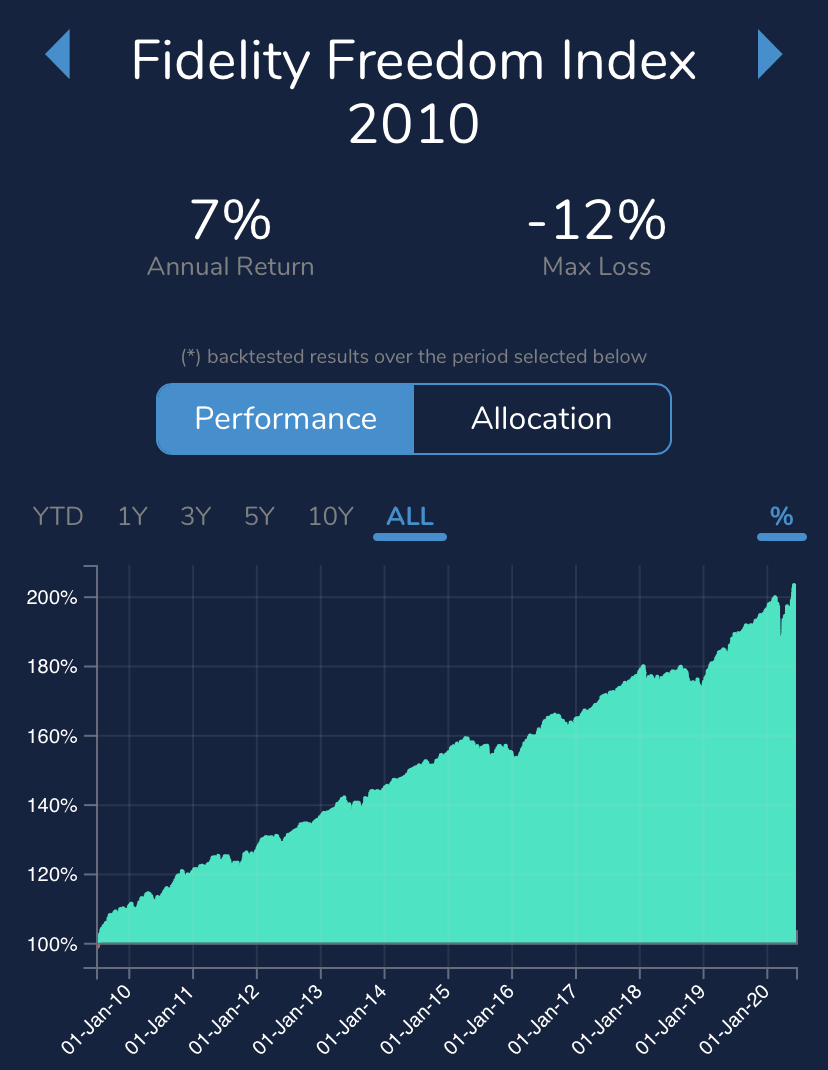

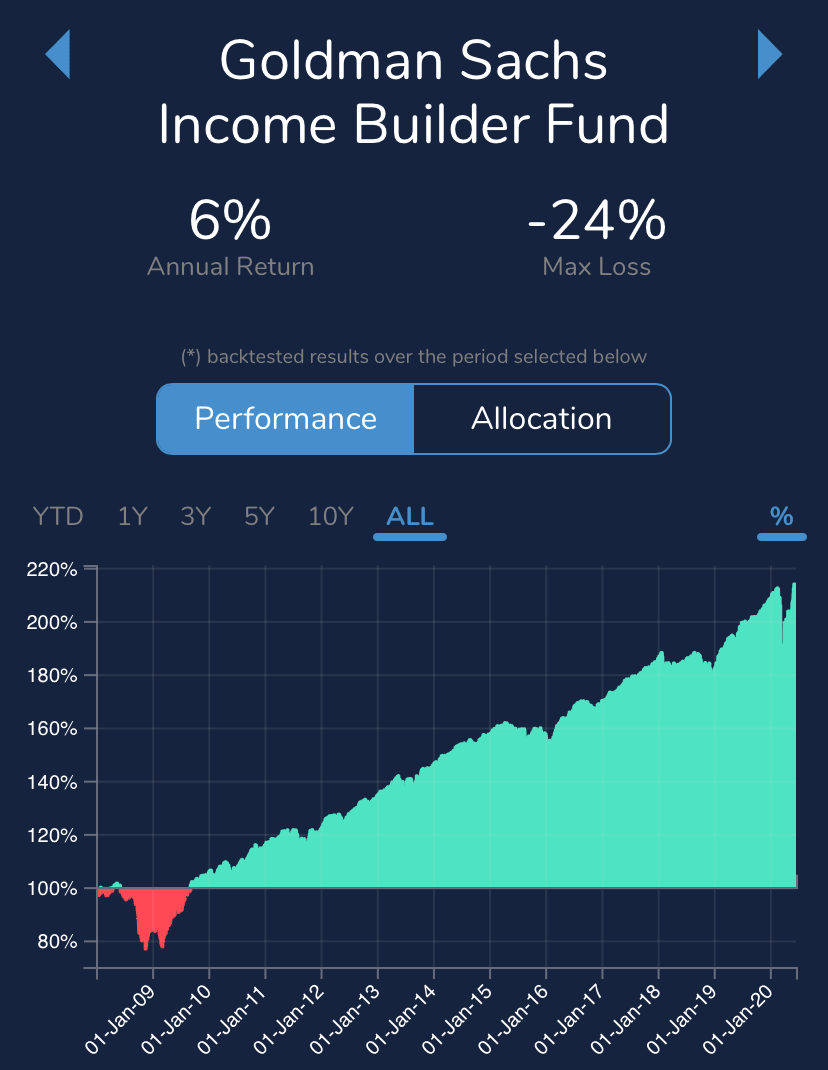

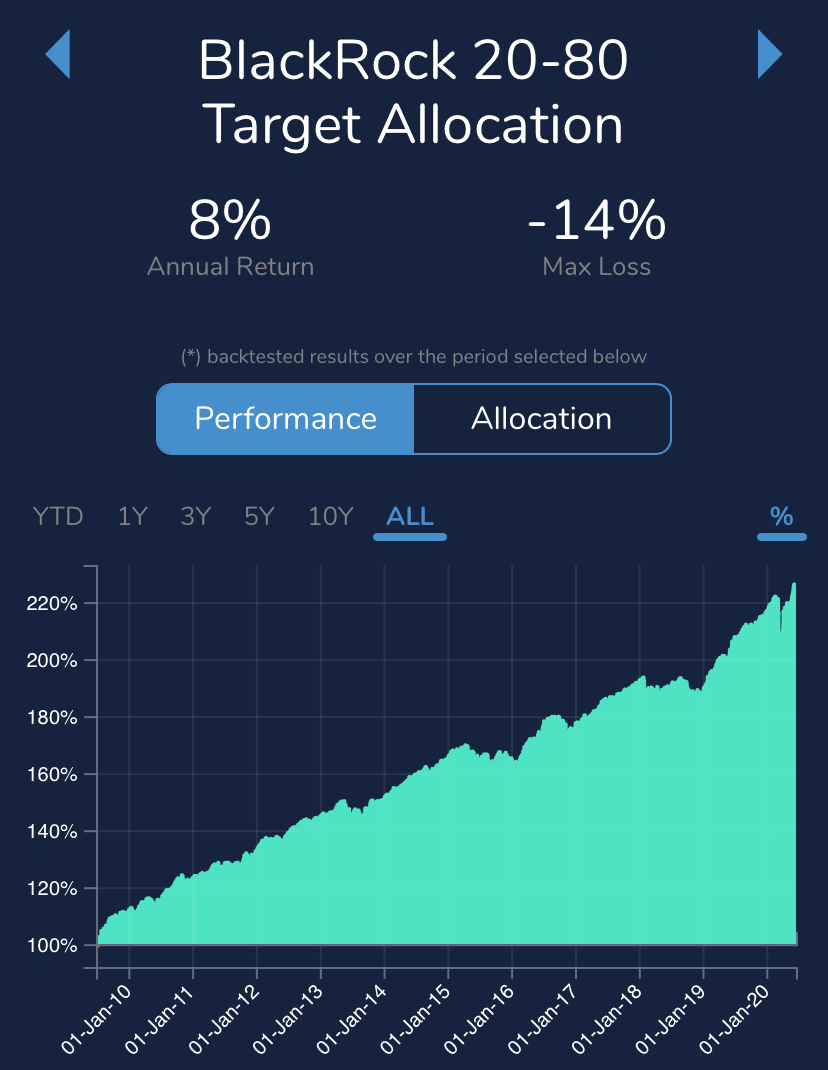

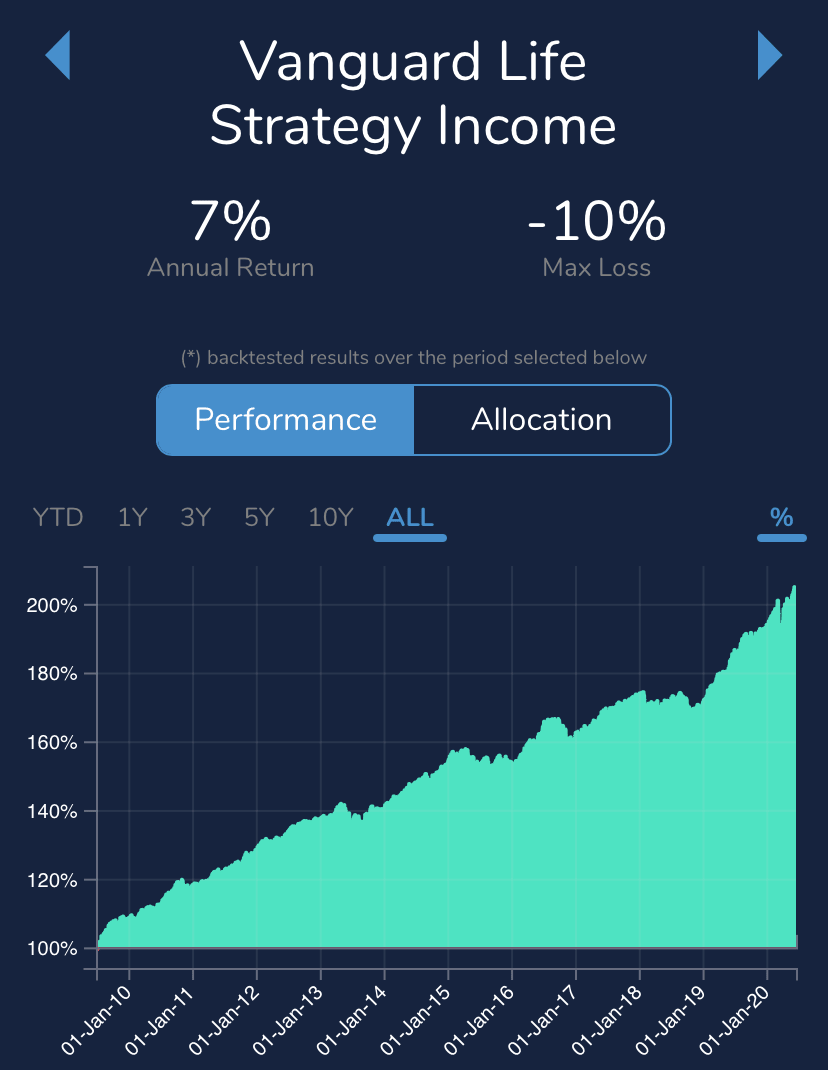

GWAP powerful Builder gets you started with Model Portfolios that replicate asset allocation strategies used by top Morningstar rated funds. Asset allocation is responsible for 90% of a fund’s performance, so you are already off to a great start.

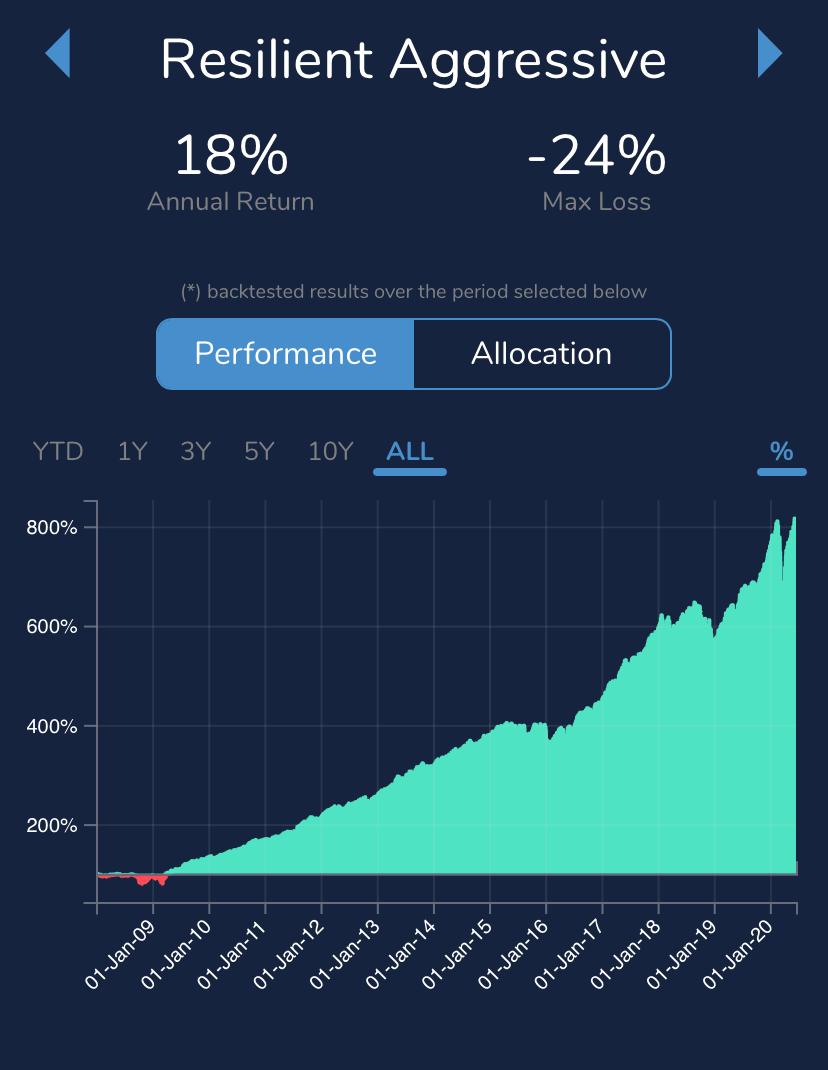

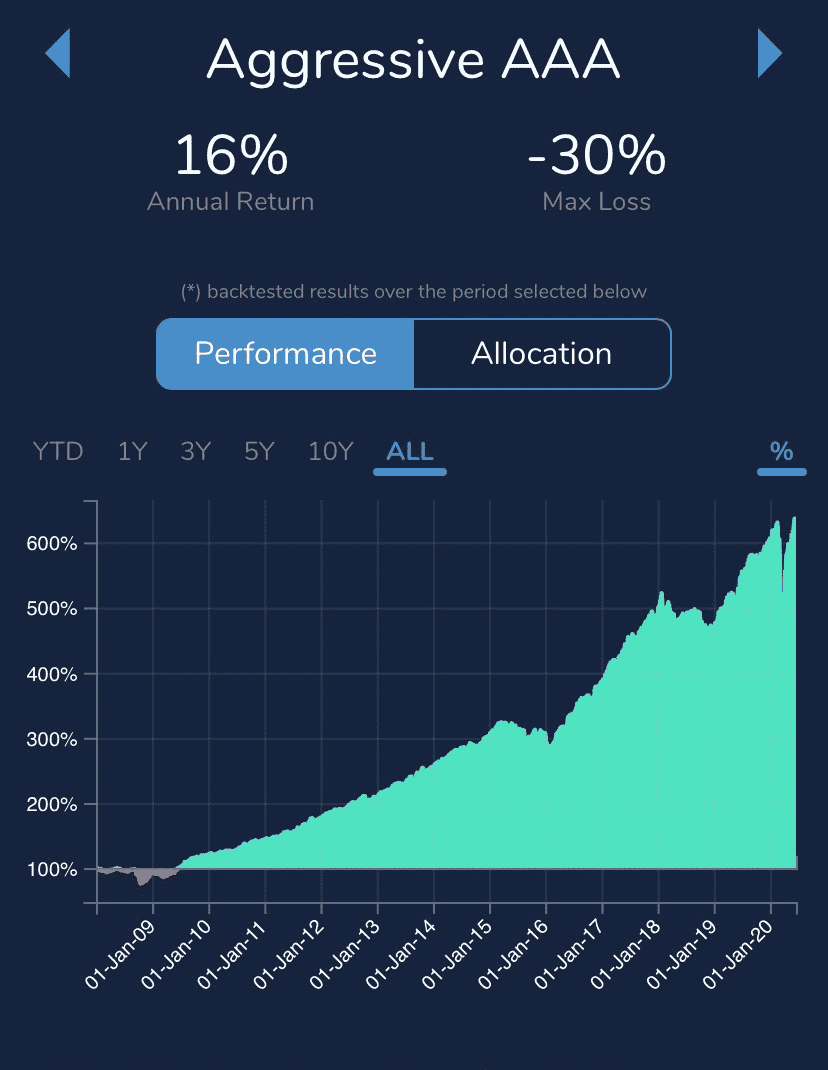

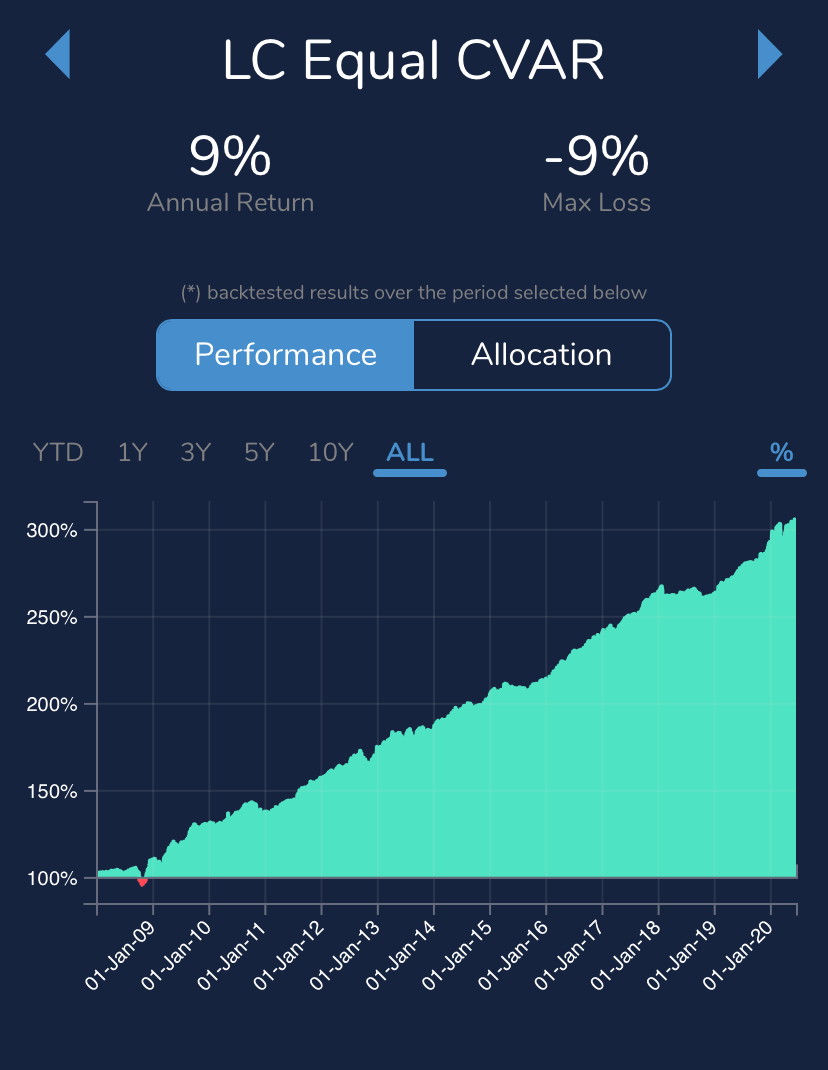

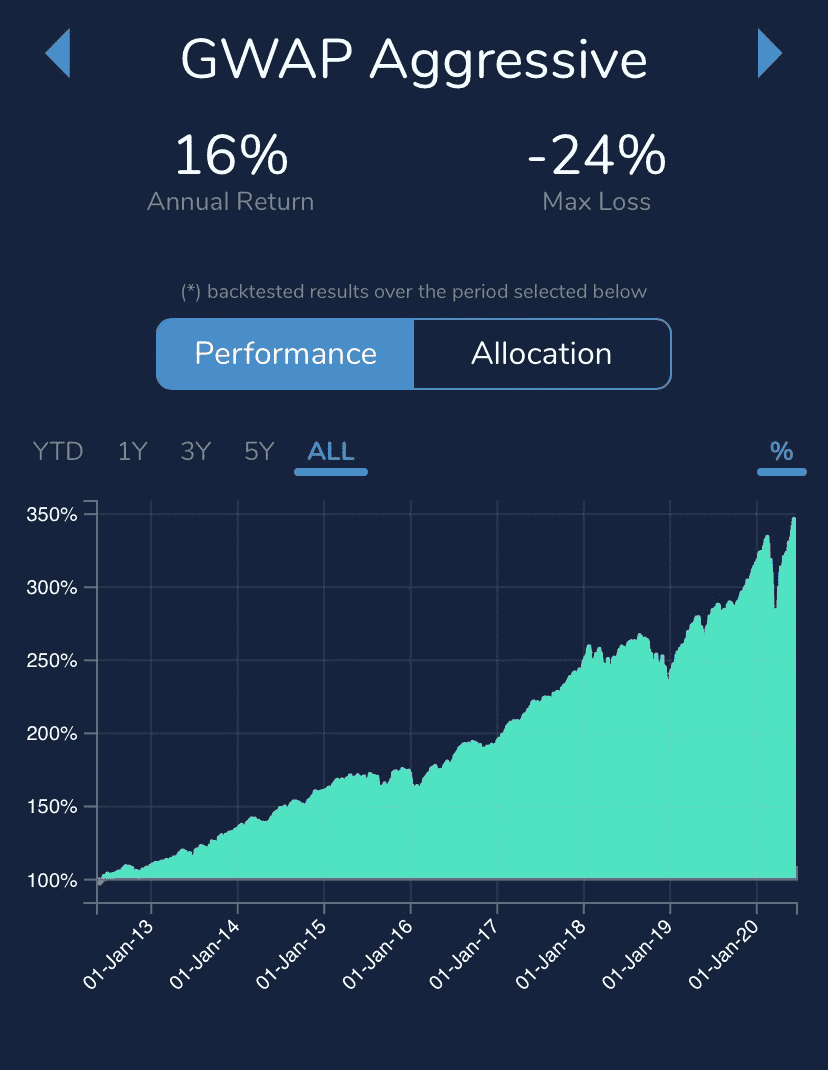

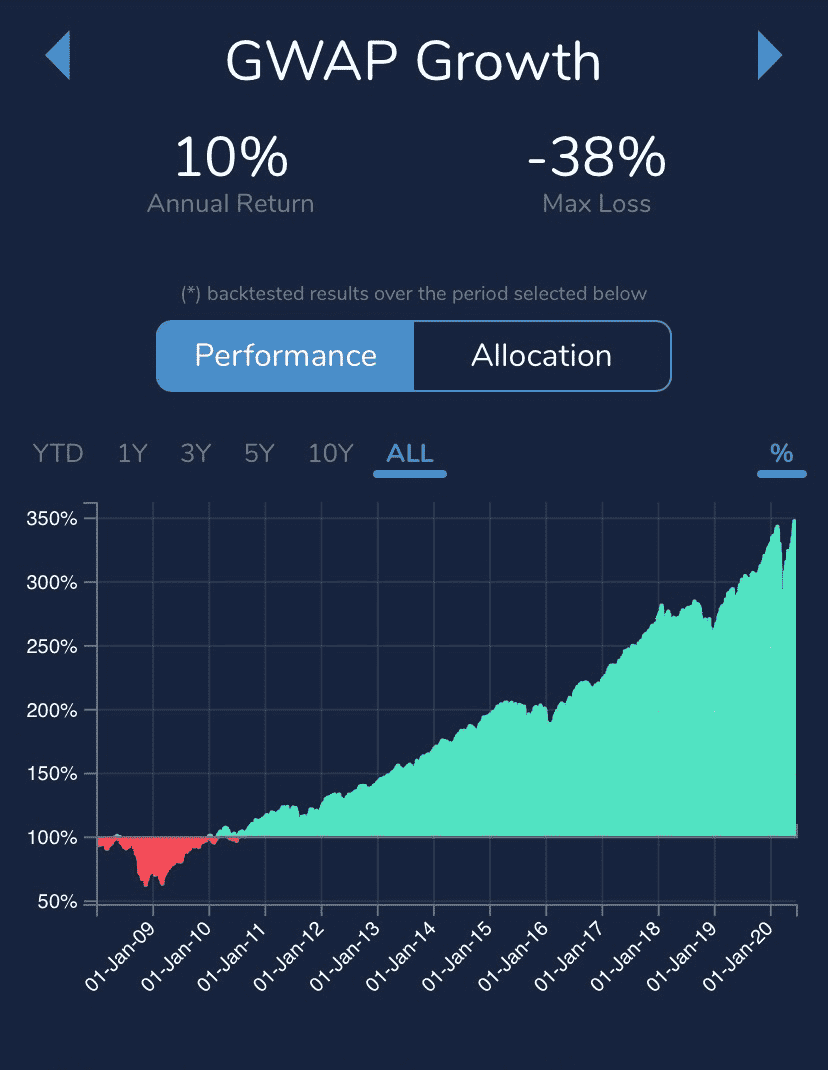

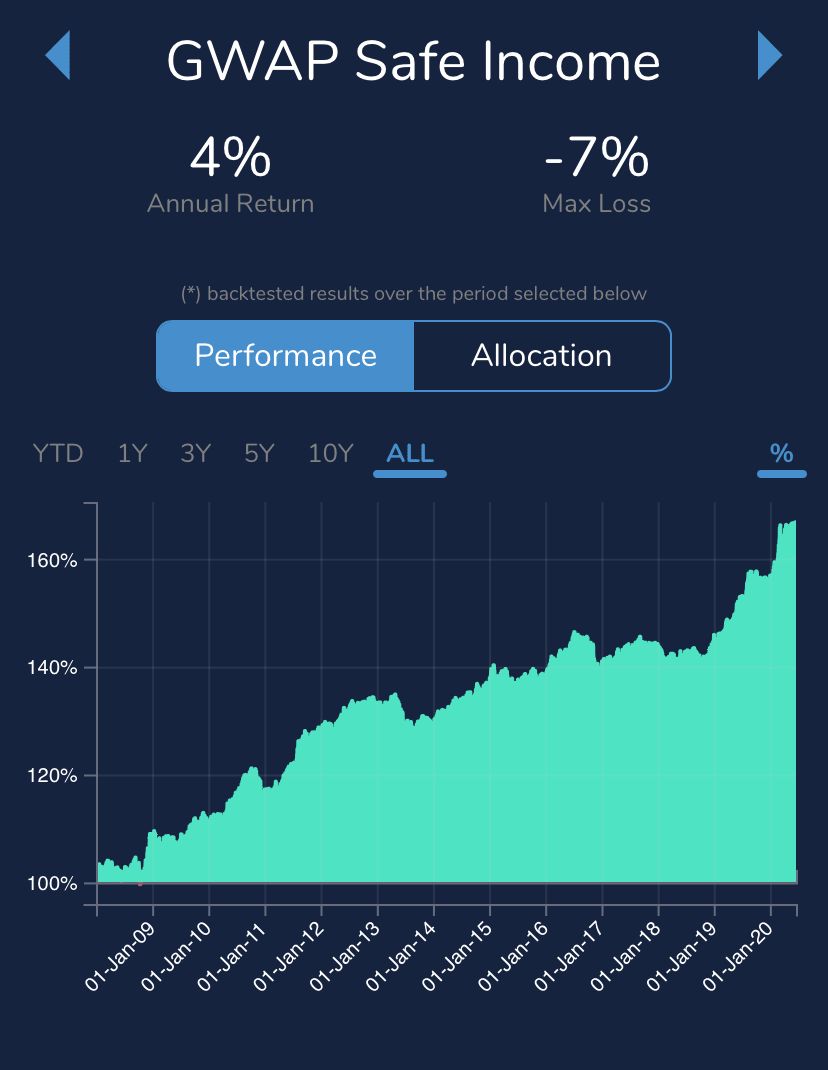

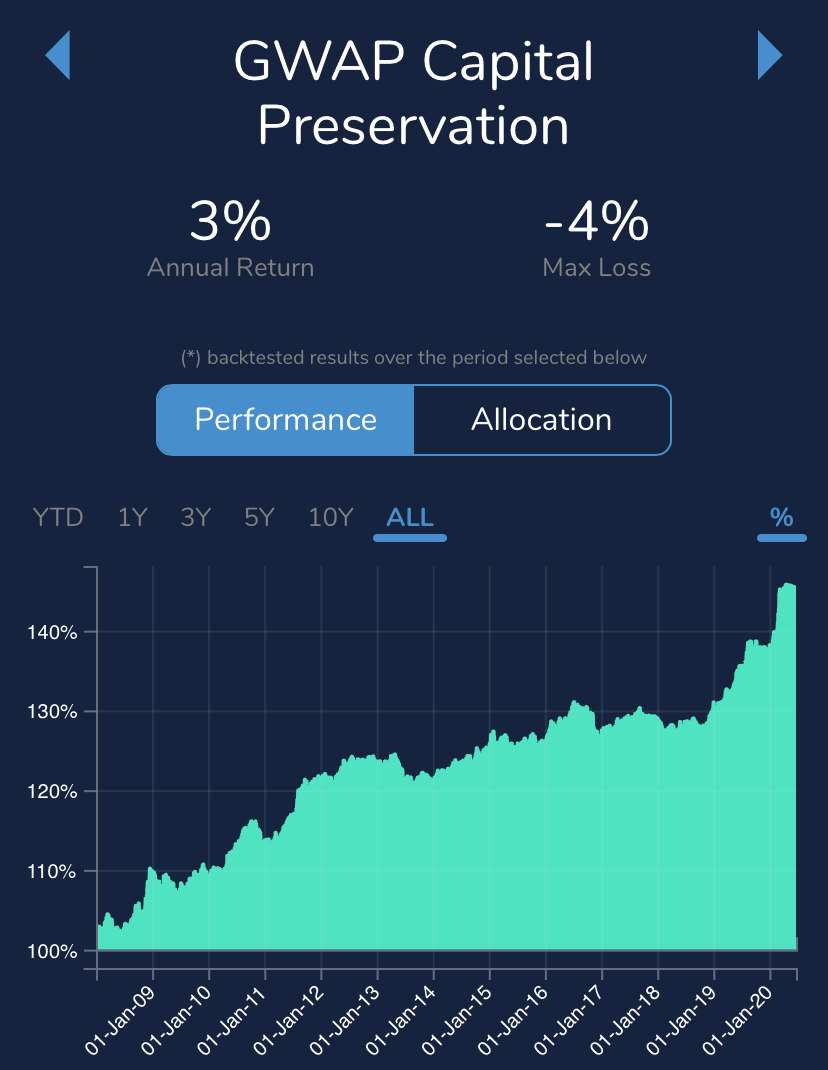

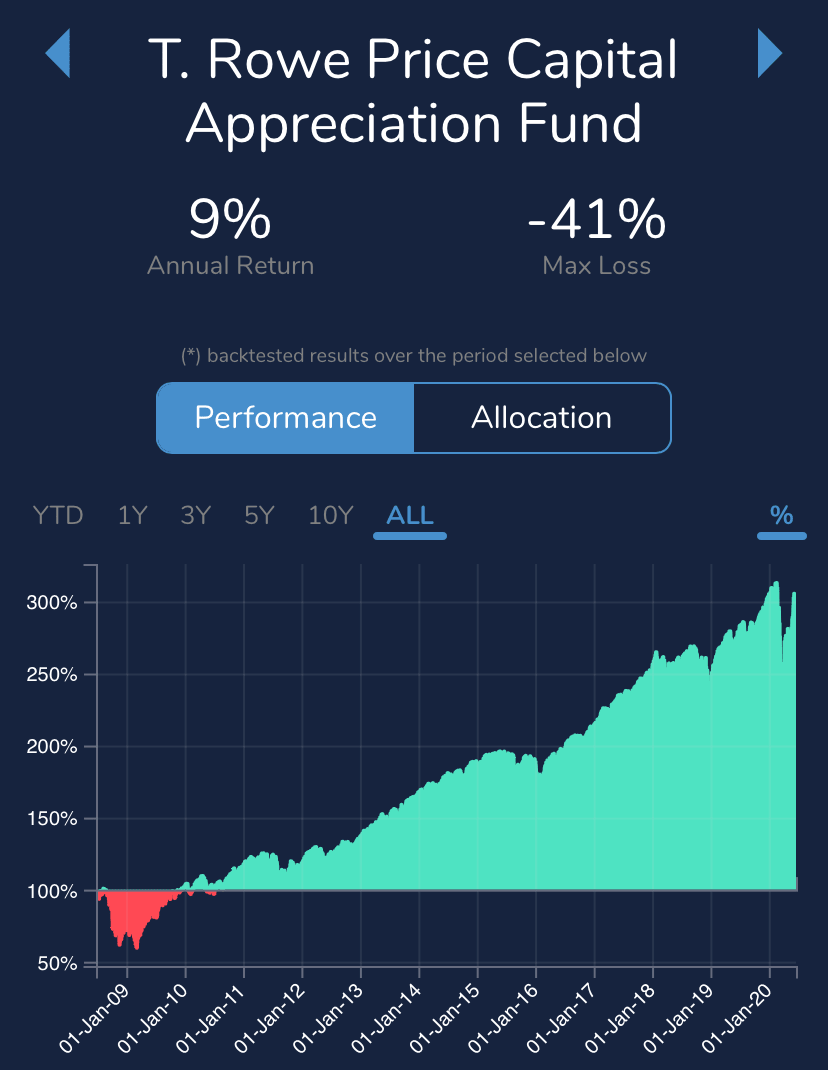

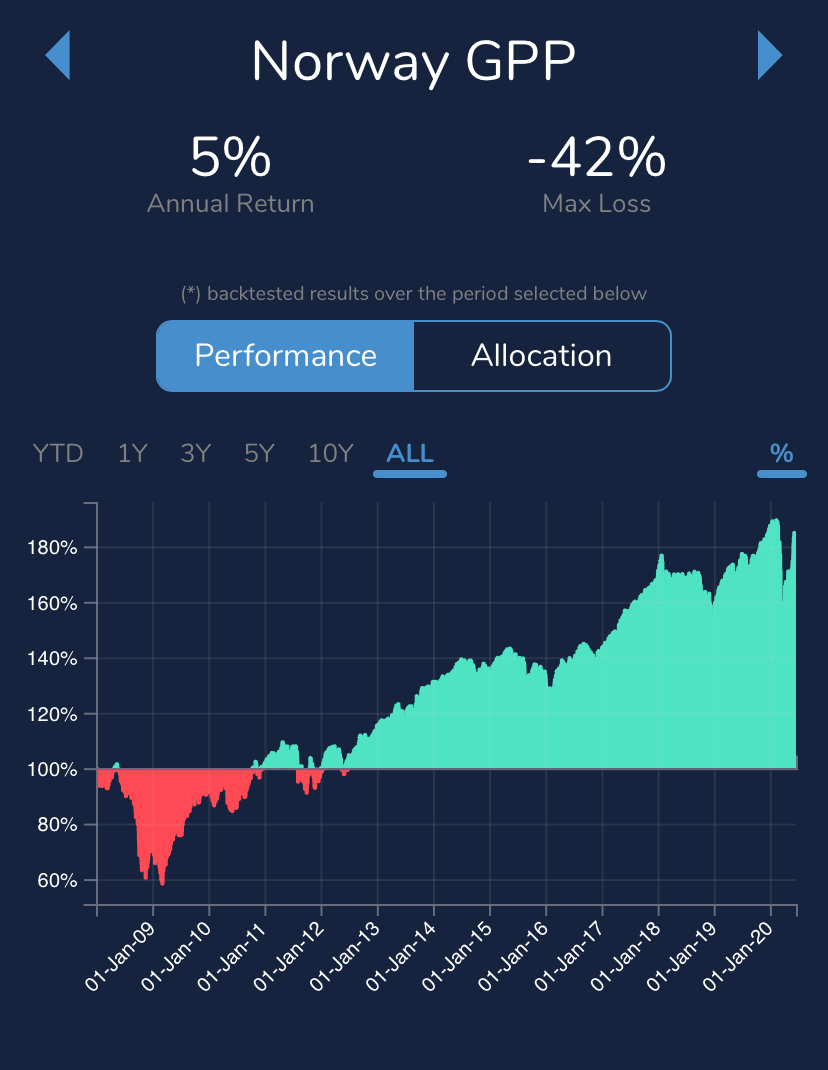

Customize your strategy and see the impact of your investment choices on Backtested historical performance, including during market stresses of 2008/09 and 2020.

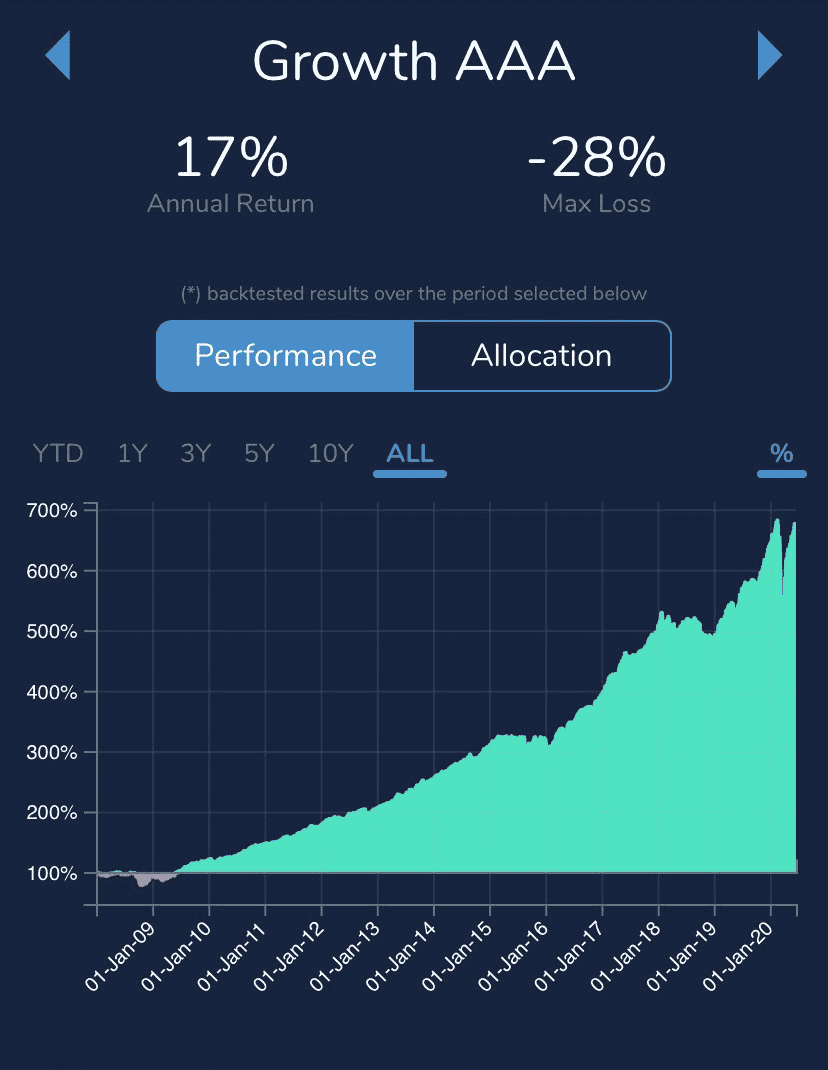

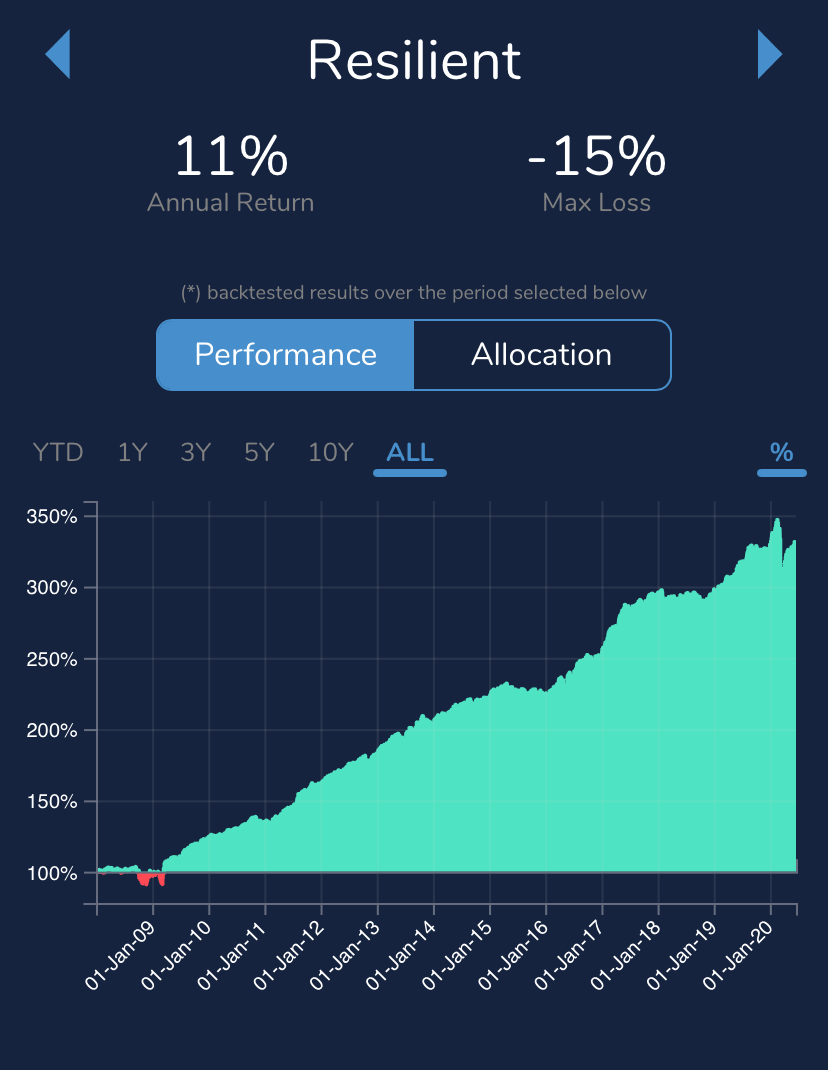

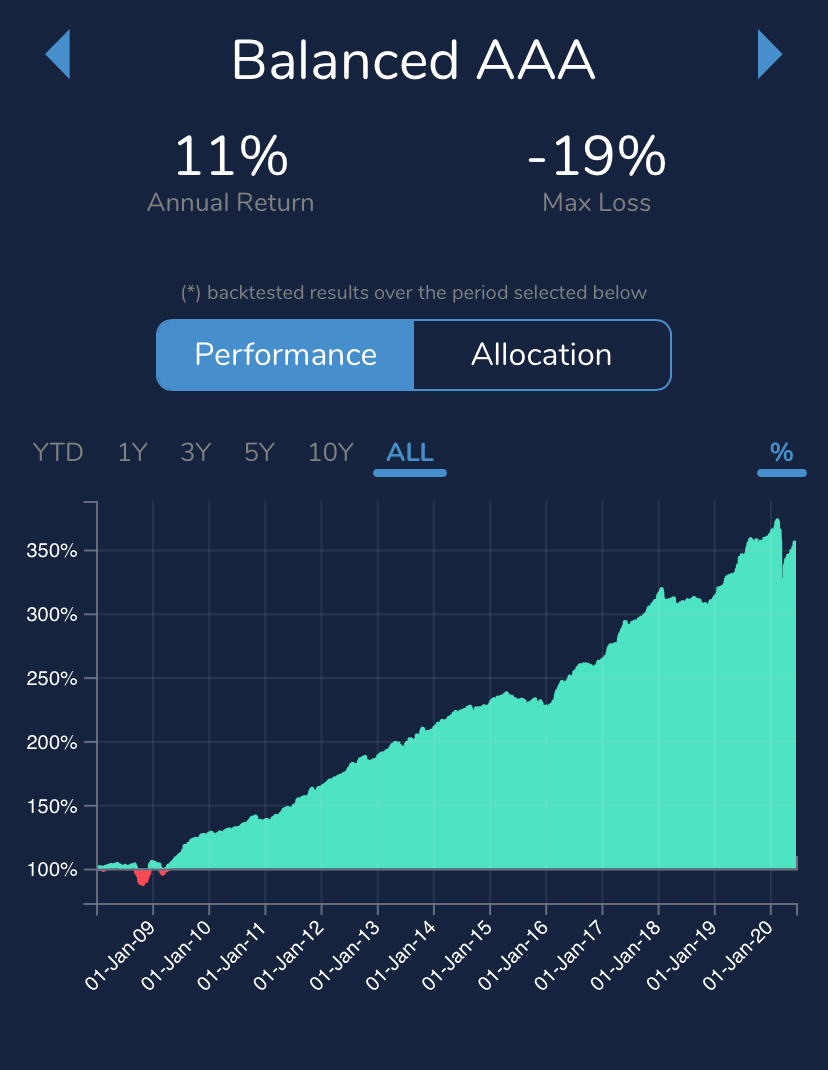

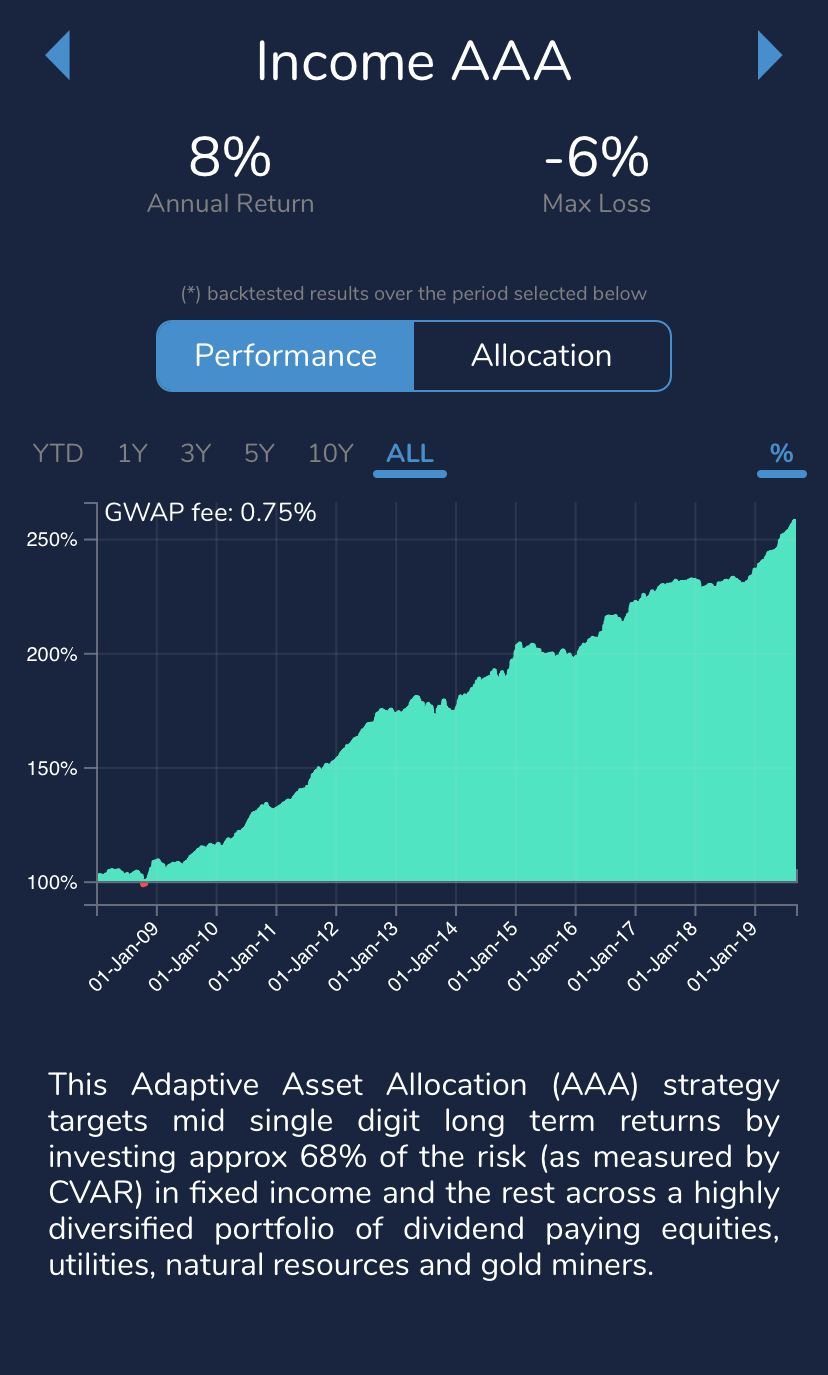

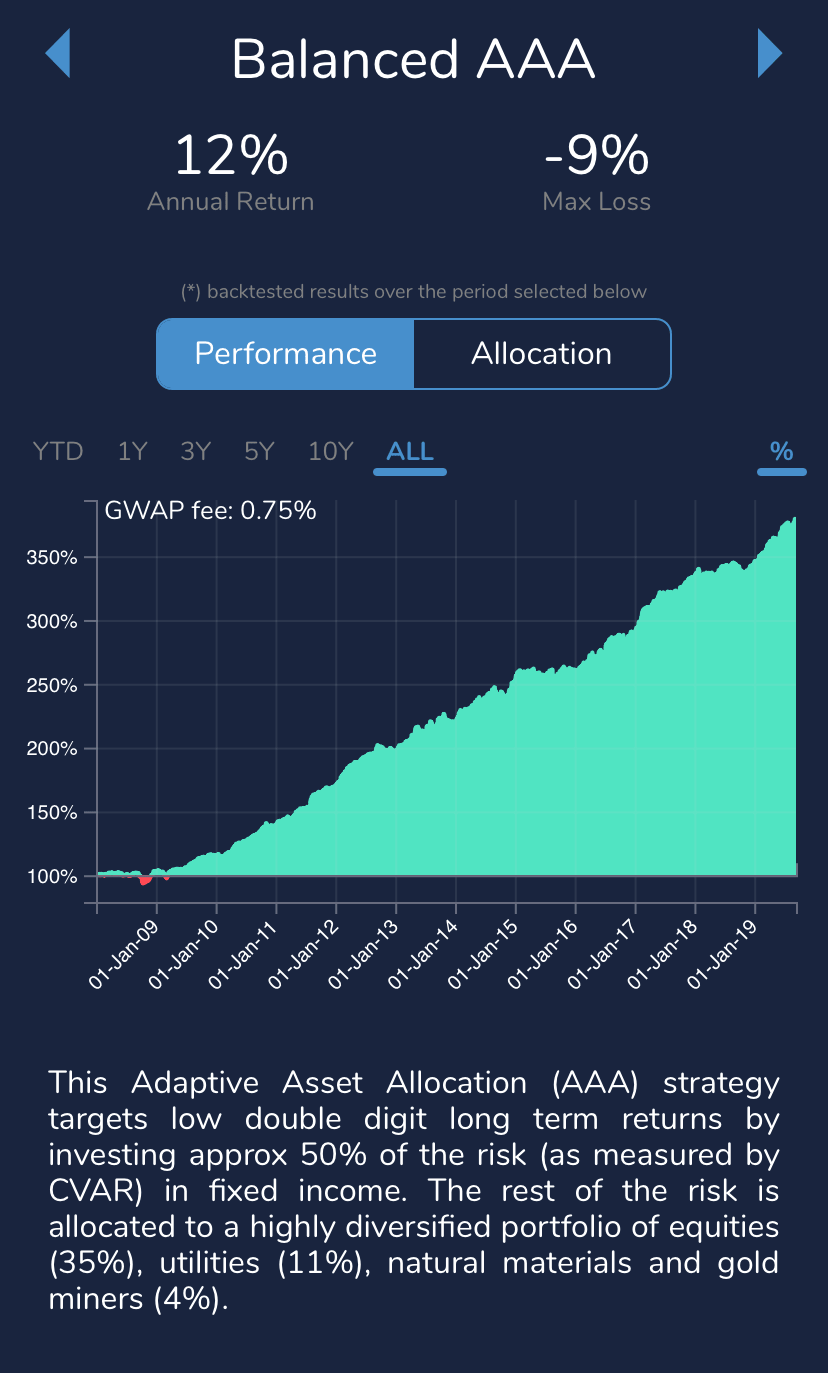

Access GWAP Adaptive Asset Allocation Strategies (AAA) which use machine learning optimization algorithms to adjust exposures periodically by increasing weights to relatively cheaper and less volatile asset classes, while decreasing allocations to expensive and more volatile assets.

All GWAP portfolios are updated regularly, so if you follow one of our Models, your strategy will evolve over time.

Implement your strategy seamlessly via our Trading interface with Interactive Brokers (IB). If you do not have an IB account, you can download your model portfolio in Excel for further implementation on a different brokerage platform.

Sign Up for GWAP Pro. The first month is complimentary, with no commitment and no credit card required. The license fee is only $199/ year thereafter.

Swiss wealth management at a fraction of the traditional private banking cost.

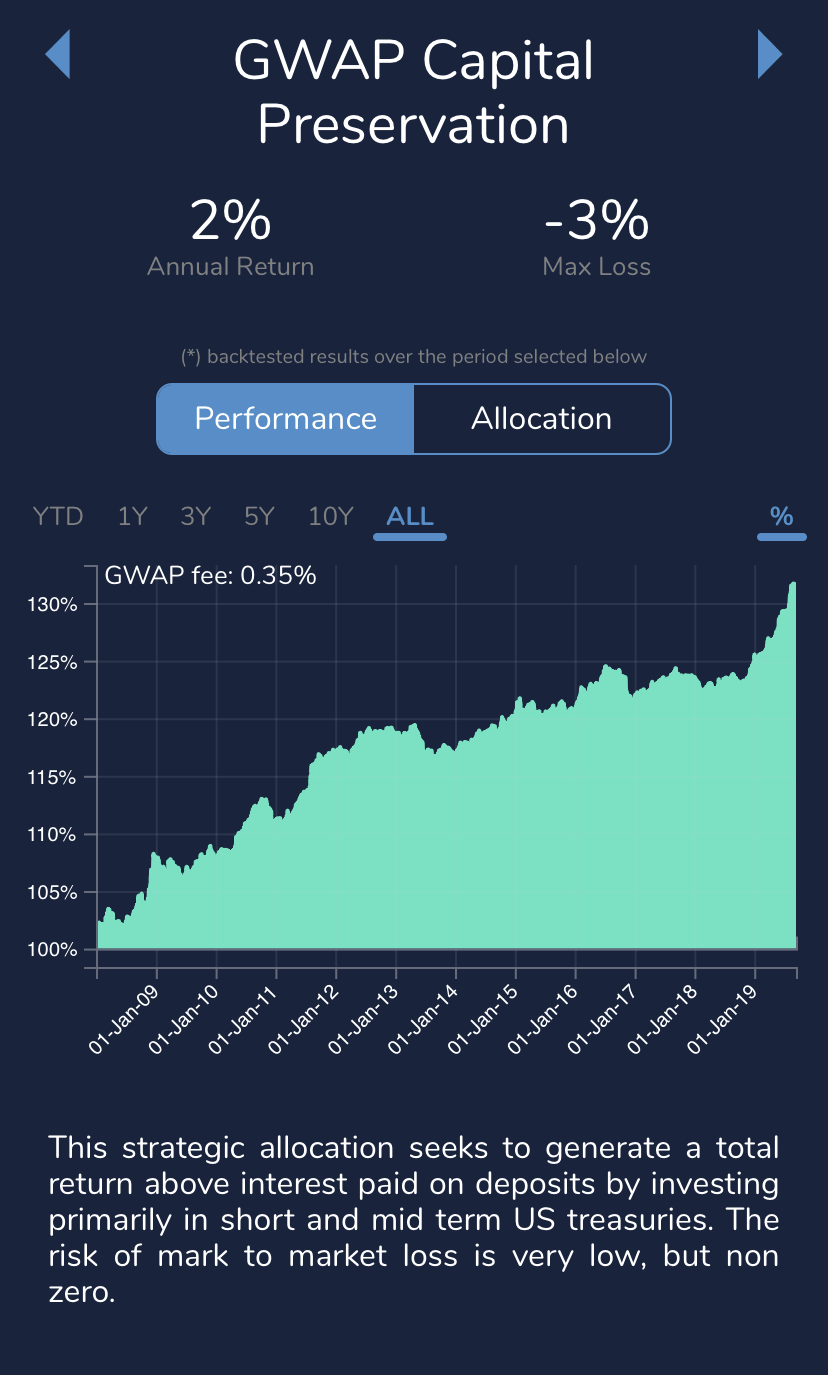

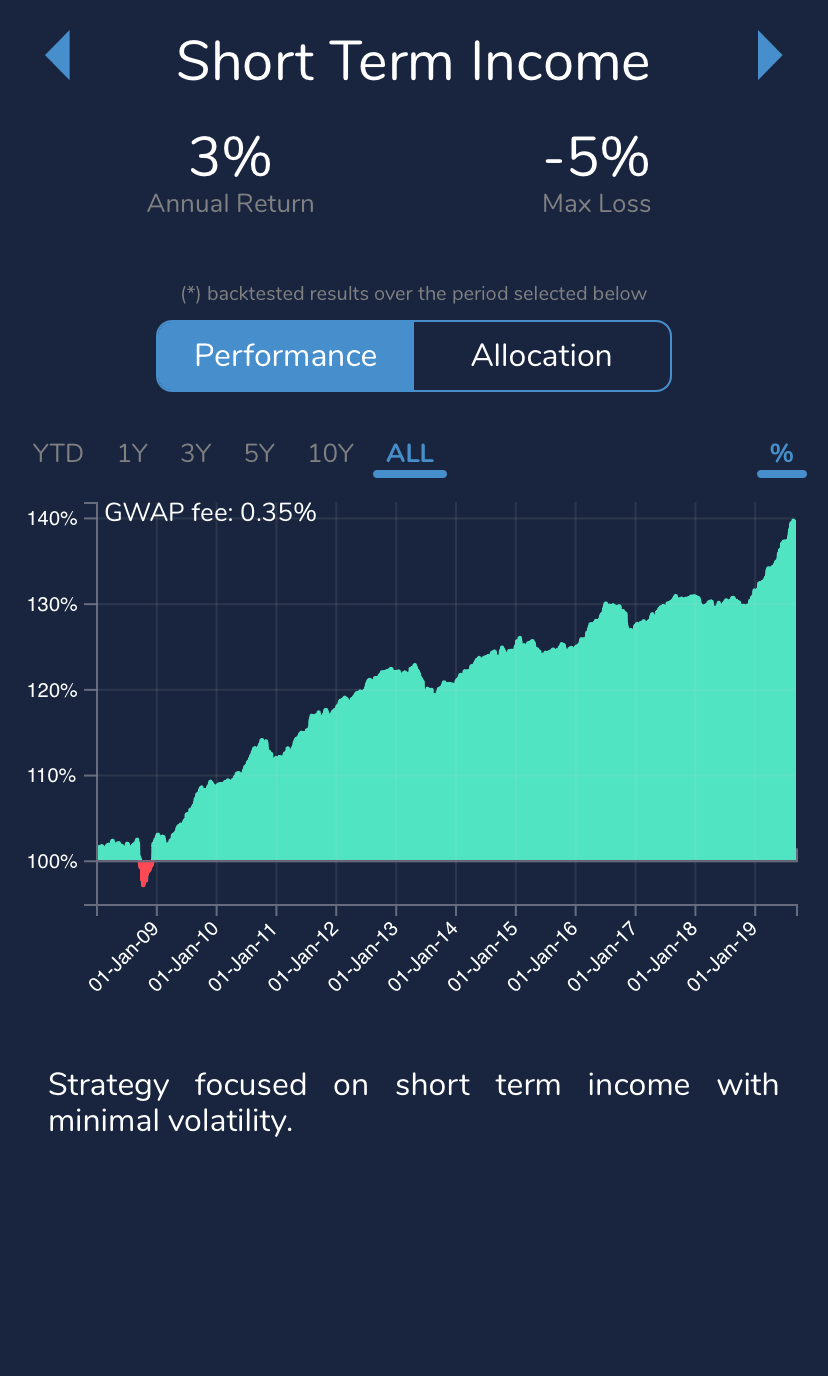

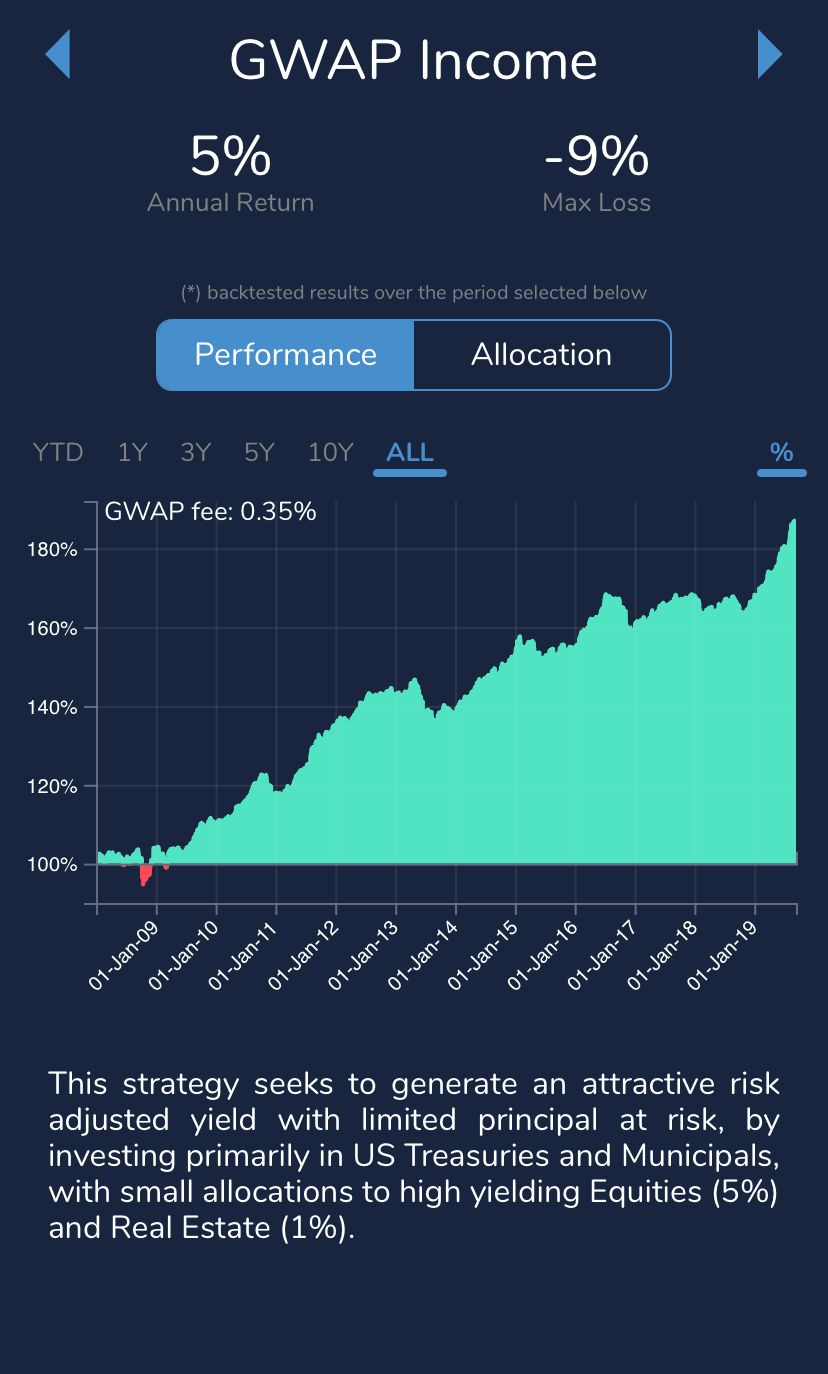

Our Strategic Model Portfolios are inspired by top performing asset managers. GWAP Adaptive Asset Allocation (AAA) portfolios use machine learning to adjust dynamically to the ever changing market conditions. See our backtested performance further down.

Choose ready-made portfolios, or create your own with our powerful Builder. We take care of the rest.

Your assets are safe in your dedicated account with Interactive Brokers (IB). GWAP Financial Sarl will receive a power of attorney from you, to invest your assets. However you remain in full control over your deposits and withdrawals.

Monitor your portfolio performance in real time on your smartphone, tablet, or desktop and receive monthly activity statements and annual tax reporting from IB.

You can start investing with as little as $2,000. Our management fee is 0.35% per annum on your average account value. We will waive your first year software license fee of $19/ month, or $199/ year. That is as cost efficient as it gets anywhere in Switzerland.

Learn by Doing! Create and manage realistic Virtual Portfolios.

Start with one of our professional model portfolios inspired by top performing asset managers, or create your own using the powerful Builder. You can create multiple portfolios, of different risk levels, so you can see what works best for you.

Monitor your performance in live, realistic market conditions.

GWAP Learn is absolutely Free, with no obligation and no commitment.

You can always upgrade to GWAP Pro, or GWAP Advisory, when you are ready to invest.

Machine Learning Adaptive

Machine Learning Adaptive

Follow Smart Money

Follow Smart Money

Meet the founders

Pursuing her passion for mathematics, Cristina earned a Master Degree in Actuarial Science from the University of Lausanne. She worked for more than ten years with large multi-nationals in Switzerland as an Actuarial Consultant.

Florin is passionate about software development, internet privacy and efficient software architectures. He brings an extensive experience as an entrepreneur in Finland, as well as in the corporate world, having spent 9 years with Nokia.